USD/VND rate expected to remain stable until year-end

In addition to a weakening US dollar, the ample supply of dollars thanks to Vietnam’s record trade surplus is a major factor that could keep a stable USD/VND exchange rate.

The USD/VND exchange rate in the last four months of the year is expected to remain stable, thanks to a weakening US dollar, Vietnam’s record trade surplus and enriched foreign exchange reserves, Ngo Dang Khoa, head of Global Markets at HSBC Vietnam, told VnExpress.

| The USD/VND exchange rate in the last four months of the year is expected to remain stable. |

There have been no major changes to the USD/VND exchange rate in the past two months. Specifically, the USD selling prices in the free market have been close to the ones quoted by commercial banks.

At Vietcombank, the USD selling prices are hovering around VND23,060 – 23,270.

In a poll conducted by Reuters in early September, 47 out of 75 economic experts expected the dollar’s weakening trend would continue for at least another three months.

These experts suggested that the interest rate incentive, which was the biggest driver of the dollar's supremacy for well over two years, has fallen as reflected in lower yields on US assets after the announcement last week the US Fed would tolerate periods of higher inflation and focus on employment.

Meanwhile, the poll also revealed the dollar's downtrend will continue into next year, driven largely by the Fed's shift to a new policy framework.

In addition to a weakening US dollar, the ample supply of dollars thanks to Vietnam’s record trade surplus of US$11.9 billion is also a major factor that could keep a stable USD/VND exchange rate in the coming time.

On September 4, the Vietnamese government informed Vietnam’s foreign exchange reserves reached a new record high of nearly US$92 billion and could further rise to US$100 billion by the end of this year.

As a result, the State Bank of Vietnam (SBV), the country’s central bank, could buy in an addition of US$8 billion in the remaining four months of this year.

HSBC's Ngo Dang Khoa said the Covid-19 pandemic has caused negative impacts on global trade and consumption, but Vietnam’s trading activity remains a positive spotlight.

Meanwhile, Bao Viet Securities Company (BVSC) predicted that the VND may increase slightly against the USD in the last months of 2020.

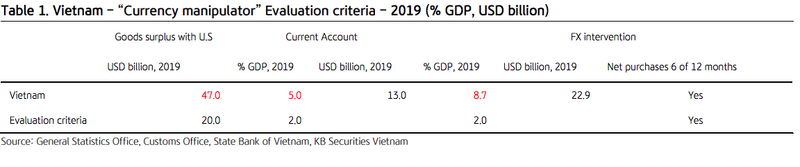

The US Department of Treasury’s recent report on Vietnam’s large purchase of foreign currency in 2019 raised the risk that the US might name Vietnam as a currency manipulator.

To prevent this risk, the SBV may suspend or limit foreign currency purchases in the short term, stated BVSC. Therefore, if Vietnam's trade surplus stays high, the VND may appreciate slightly against the USD shortly, it added.

Vietnam is currently in the US Department of Treasury’s monitoring list for currency manipulation, which also comprises China, Japan, South Korea, Germany, Italy, Ireland, Singapore, Malaysia and Switzerland.

According to the US agency, an economy that meets two of the three criteria in the Trade Facilitation and Trade enforcement Act of 2015, or the 2015 Act, is placed on the monitoring list.

Among these three criteria is “the persistent, one-sided intervention occurs when net purchases of foreign currency are conducted repeatedly, in at least six out of 12 months, and these net purchases total at least 2% of an economy’s GDP over a 12-month period.”

Regarding this issue, banking expert Nguyen Tri Hieu previously told Hanoitimes that it is unlikely that Vietnam would be labeled as a currency manipulator by the US, given the former’s modest size of foreign exchange reserves compared to other countries.

“The amount that the SBV is said to have purchased is too small to exert a major impact on the global financial market, or for the US to consider Vietnam as a currency manipulator,” Hieu stated.

KB Securities Company (KBSC) said Vietnam has a legitimate reason to increase foreign exchange reserve, referring to the International Monetary Fund (IMF)’s previous assessment that at the end of 2018, the Vietnam’s foreign exchange reserve has been about 76% of IMF’s reserve adequacy metric for fixed exchange rate regime.