Vietnam GDP growth projected to strengthen to 6.5% in 2021: IMF

The upward trend in economic growth would continue to 2022 as the country’s economic growth may reach 7.2%.

Vietnam’s GDP growth is projected to strengthen to 6.5% as normalization of economic activity continues, businesses recover, and private consumption and business investment rebound.

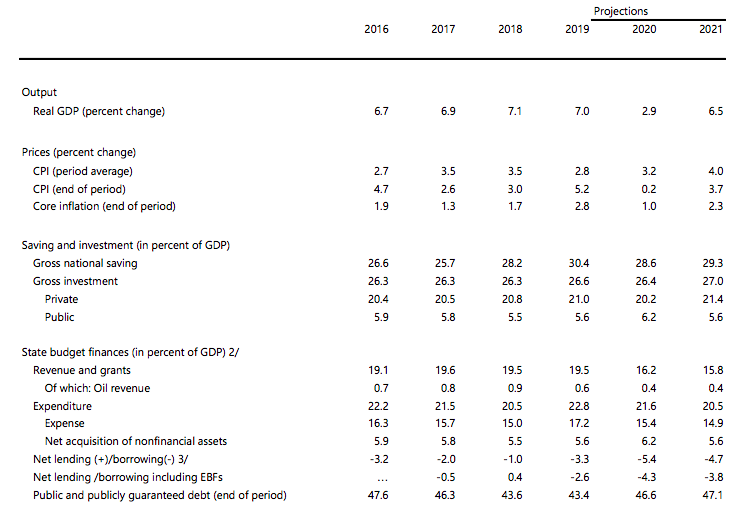

| Vietnam's major economic indicators. Source: IMF |

The assessment was given by the International Monetary Fund (IMF) in its 2020 Article IV Consultation report with Vietnam, expecting the upward trend in economic growth would continue to 2022 as the country’s economic growth may reach 7.2%.

“Manufacturing and retail sales are expected to lead the recovery, while the travel and hospitality services will remain subdued,” noted the report, but saying net exports will continue making positive contribution to growth as external demand picks up.

Looking back in 2020, Vietnam began the year following a prolonged period of high growth. The last three decades of market-oriented reform supported a structural transformation from agriculture to a modern economy based on FDI-led manufacturing, lifting Vietnam from one of the poorest countries in the world to lower middle-income status.

According to the report, in recent years, growth averaged 7%, and the emphasis on “leaving no one behind” boosted living standards, contributing to notable progress towards the Sustainable Development Goals.

Economic activity remained strong with stable inflation in 2019, as the rate of new business creation reached a six-year high. Fiscal consolidation efforts helped contain public and publicly guaranteed debt to 43% of GDP, well below the 65% statutory limit.

Despite moderating trade flows on account of US-China trade tensions, the current account surplus rose to 3.8% of GDP as a result of sharply slowing imports of raw materials and intermediate goods, record tourist arrivals, and large remittance flows. Vietnam’s external position in 2019 was assessed to be substantially stronger than warranted by fundamentals due to structural features.

Following the onset of the Covid-19 crisis, decisive measures were taken to limit the health and economic fallout. Early and concerted efforts helped ease lockdown restrictions and contain the associated policy support package relative to other countries.

Fiscal policy focused on temporary support to firms and vulnerable households, while monetary policy was eased to maintain abundant liquidity in the banking system. Real GDP growth in 2020 was 2.9%, among the highest in the world, noted the report.

Risks and solutions going forward

Despite some economic scarring, a strong recovery is expected in 2021 as normalization of domestic and foreign activity continues, stated the IMF Executive Board. Fiscal and monetary policies are expected to remain supportive, although to a lesser extent than in 2020, and inflation is projected to remain close to the government’s target at 4%.

The directors, meanwhile, stressed the need for measures to limit permanent scarring and promote sustained, inclusive, and greener growth.

They underscored the need for fiscal measures geared towards protecting workers and vulnerable households, including through improved budgetary execution and enhanced targeting.

“Once the recovery is firmly underway, gradual fiscal adjustment should center on revenue mobilization to help create space for priority social and infrastructure spending and support greener and more inclusive growth,” stated the directors.

They also noted the need for continued efforts to upgrade fiscal policy frameworks to safeguard fiscal sustainability.

The Directors recommended maintaining an accommodative monetary policy stance, while remaining mindful of underlying banking sector vulnerabilities. They emphasized that corporate support for viable firms should be gradually phased out and regulatory forbearance normalized.

Noting the view that Vietnam’s external position was substantially stronger than warranted by fundamentals and desirable policies, the Directors called for steadfast reform efforts to remove the remaining barriers to private investment and enhance social safety nets.

They stressed the importance of structural reforms to improve the business environment, enhance productivity, and boost post-pandemic potential growth. They concurred that priority should be given to reducing labor skill-mismatches, promoting digital transformation, and ensuring a level playing field, particularly for SMEs. The Directors welcomed continued efforts to improve economic institutions and strengthen governance.