Vietnam to remain safe from US trade tariffs: Fitch Solutions

Vietnam recognizes its growing trade surplus with the US and is actively seeking to narrow this surplus to avoid meeting the same fate of damaging trade tariffs that has befallen China.

Vietnam will be safe from punitive trade tariffs from the US, especially over the near term, according to a report from Fitch Solutions.

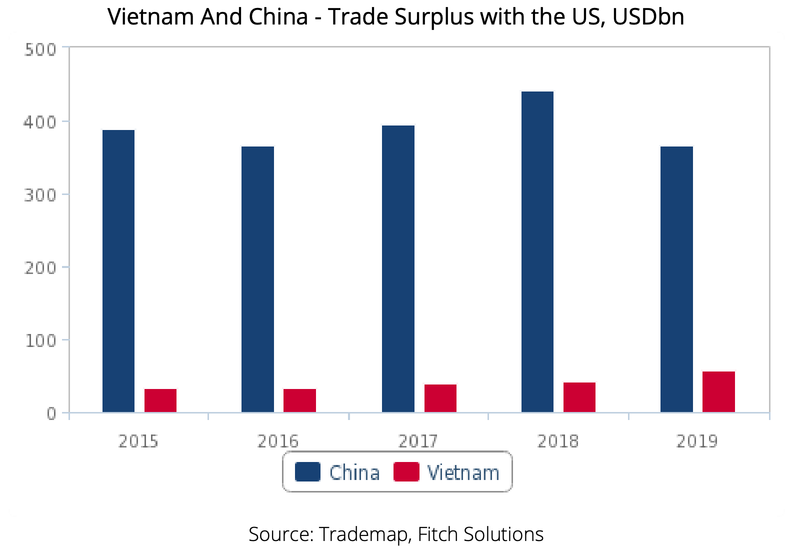

Vietnam’s trade surplus with the US has steadily grown from US$32.6 billion in 2015 to US$58.5 billion in 2019, exceeding the US$20 billion which would put a country on the US currency manipulator watchlist.

From the US perspective, Washington at this juncture is likely to be focused on the upcoming presidential elections in November and on the evolving Covid-19 epidemic globally, as opposed to tackling trade imbalances. From Vietnam’s perspective, there are three reasons to back up such an assessment.

First, Vietnam recognizes its growing trade surplus with the US and is actively seeking to narrow this surplus to avoid meeting the same fate of damaging trade tariffs that has befallen China. Most recently, Vietnam has committed, on March 4, to buy US$3 billion worth of farm products from the US over the next two to three years.

According to a director general of Vietnam’s agriculture ministry, the US$3 billion deal would include purchases of 100,000 cows, 3 million tons of wheat and barley (worth about US$800 million), fruit, corn, and soy animal feed.

This deal represents a further effort by Vietnam to narrow its trade surplus with the US, following Prime Minister Nguyen Xuan Phuc’s promise at the G20 meeting in Japan in June 2019 to buy large volumes of liquefied natural gas from the US.

Additionally, state-run Vietnam National Coal-Mineral Industries’ also announced that it was in negotiations to buy US coal from Xcoal Energy & Resources LLC in August. In January 2019, Vietnam’s Bamboo Airways and VietJet Aviation JSC in February 2019 also inked agreements to buy 110 Boeing aircraft. While these gestures on their own would not meaningfully narrow Vietnam’s trade surplus with the US, it is expected this is still a symbolic move to stave off tariffs, especially over the near term.

This is because these purchases are targeted at key segments of US President Donald Trump’s support base, which is especially important considering the presidential elections in November. These segments are namely farmers, the state of Pennsylvania (where Xcoal Energy & Resources LLC is based and also a key political battleground during the presidential elections), and the aircraft/defense industry, which donates generously to political campaigns, with more than half of donations going to Trump’s Republican Party.

Second, Vietnam remains at lower risk of being labelled a currency manipulator. Vietnam still only meets two of the US three criteria for assessing unfair currency practices and/or accumulating excessive external imbalances which could weigh on US growth or harm US workers and businesses.

The three criteria include (1) a significant bilateral trade surplus with the United States is one that is at least US$20 billion over a 12-month period; (2) a material current account surplus is one that is at least 2% of gross domestic product (GDP) over a 12-month period; and (3) persistent, one-sided intervention occurs when net purchases of foreign currency are conducted repeatedly, in at least six out of 12 months, and these net purchases total at least 2% of an economy’s GDP over a 12-month period.

Fitch Solutions noted that China was labelled a currency manipulator in August 2019, (this was later removed with the signing of the ‘Phase-one’ trade deal) despite not meeting all three of the above criteria, namely the third one. Nonetheless, given Vietnam’s smaller size and therefore smaller impact on the US economy, it remains less likely to be labelled a manipulator.

Vietnam’s trade surplus of US$58.5 billion puts it in violation of the first criteria. Its current account surplus, which is estimated to be 2.2% of GDP as of the latest available data from September 2019 also exceeds the threshold of 2%. However, it does not violate the third criteria, which requires one-sided interventions of net purchases of foreign currency to weaken the domestic currency.

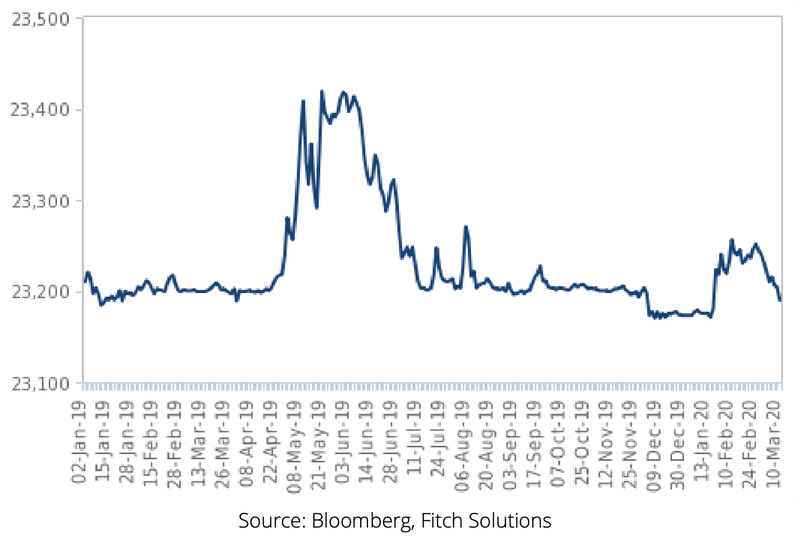

The US Treasury’s January 2020 assessment with data up to June 2019 noted that “the Vietnamese authorities have credibly conveyed to Treasury that net purchases of foreign exchange were 0.8% of GDP over the four quarters through June 2019” and that “Vietnam intervenes in foreign exchange markets frequently, and in both directions, to maintain a close link to the dollar.” Given that the Vietnamese dong has remained fairly stable at around VND23,200/USD since mid-2019, this suggests that these bidirectional interventions have continued.

| Vietnam - Exchange Rate, VND/USD. |

Third, Vietnam plays a key role in helping the US counter-balance growing Chinese influence in the region. Persistent tensions between Vietnam and China in the South China Sea will continue to present Vietnam as a compelling counterweight in the region for the US.

Therefore, Fitch Solutions believed that the US needs to maintain strong relations with Vietnam will also help Vietnam stave off tariffs on its exports over the near term. Vietnam being aware that it will find it difficult to effectively retaliate or even achieve its desired growth targets should it come under punitive tariffs would also be an important motivation to continue engaging the US in discussions to avoid these tariffs becoming a reality.

From the US perspective, the growing domestic and global outbreak of Covid-19 will also see management of the epidemic take precedence over the addressing of trade imbalances. Notwithstanding the growing death toll from the virus and growing community spread in the US, the US government will also have to grapple with a severe supply and demand shock on its domestic economy brought about by the virus’ devastating impact on global economic activity.

Fitch Solutions expected the larger threat of the virus to therefore prevent an escalation in trade tensions between the US and its main trading partners over the near term.