Vietnam's manufacturing activity shows strengthening in business conditions

Firms remained optimistic that output will rise over the coming year, based on hopes that the pandemic will fade and new orders expand.

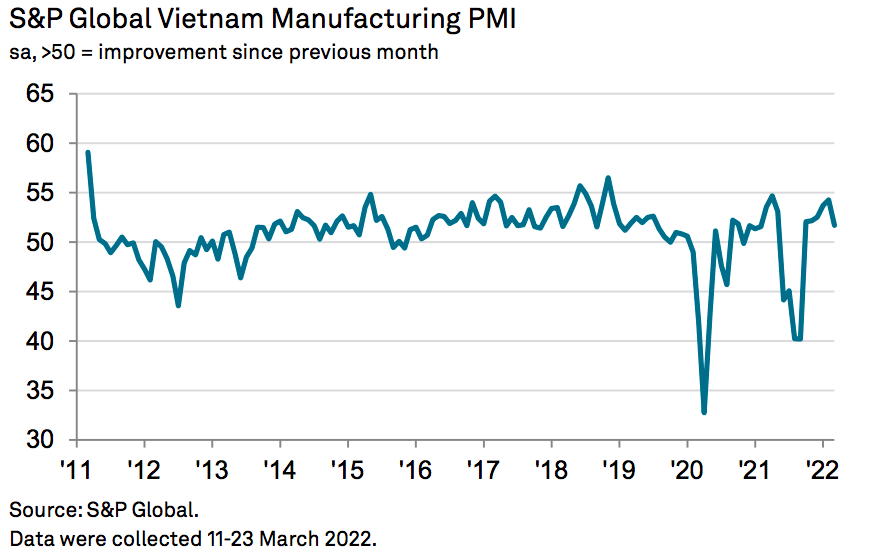

The Vietnam Manufacturing Purchasing Managers' Index (PMI) dropped to 51.7 in March from 54.3 in February, which, however, still points to an overall strengthening of business conditions.

| Production of aircraft components at MHI Aerospace Vietnam. Photo: Pham Hung |

A reading below the 50 neutral marks indicates no change from the previous month, while a reading below 50 indicates contractions, and above 50 points means an expansion, according to S&P Global.

Central to the slowdown in the rate of improvement overall was the current wave of the Covid-19 pandemic in Vietnam. One of the main impacts on firms came in the form of widespread infections among workers, resulting in a first decline in employment in four months.

“The surge in Covid-19 cases in Vietnam during March took its toll on the manufacturing sector, pushing output back into contraction territory. This was primarily due to labor shortages, as so many workers were off with infections that factories were unable to maintain production volumes,” said Andrew Harker, economics director at S&P Global.

"While firms will be hoping that infection levels start to ease soon, providing some alleviation on that front, the war in Ukraine provides a further headwind. The most noticeable impact for Vietnamese firms in March was on prices. Input costs increased at the sharpest pace in almost 11 years on the back of higher costs for oil and gas following the outbreak of war,” he said.

Staff shortages meant that firms were unable to maintain production volumes, with output falling for the first time in six months. Inflationary pressures also contributed to the drop in production, which was nonetheless only modest as some firms expanded output in line with higher new orders.

Difficulties raising production due to labor shortages led to a further accumulation of backlogs of work, with the latest increase the most marked since September last year.

The issues around the pandemic and price rises also impacted new orders at the end of the first quarter. That said, both total new business and new export orders increased for the sixth month running.

Efforts to keep up with order requirements were helped by the use of inventories given difficulties with production. As a result, stocks of finished goods decreased for the first time in three months.

Although purchasing activity rose slightly in March, the rate of growth slowed sharply and was the weakest in the current six-month sequence of expansion. Stocks of purchases were also up modestly. With current production requirements falling, any inventory building largely reflected efforts to accumulate reserves.

A range of factors led to longer suppliers' delivery times in March, including the effects of the Covid-19 pandemic such as labor shortages and restrictions at the border with China. The war in Ukraine also acted to delay deliveries, with lead times lengthening to the greatest extent since last October overall.

The severity of the latest wave of the Covid-19 pandemic and worries about inflationary pressures acted to dampen expectations for the future. Business confidence dropped to the lowest in six months. That said, firms remained optimistic that output will rise over the coming year, based on hopes that the pandemic will fade and new orders expand.