Vietnam’s northern industrial property market: Land prices rise amidst pandemic

Vietnam has attracted the majority of those who wanted to diversify their manufacturing portfolio beyond China.

Vietnam remains a promising market since the trend of factory relocation out of China began due to the Covid-19 pandemic, sending land prices soaring in the northern industrial market, JLL has said in a report.

| Long-term potential in Vietnam's industrial segment. Photo: Becamex IDC |

Although the Covid-19 pandemic was currently causing difficulties for investment decisions or relocation activities, industrial park developers remained confident of increasing land prices as they were well aware of long-term potential in Vietnam’s industrial segment, explained the leading professional services firm that specializes in real estate and investment management.

With relatively developed infrastructure and proximity to China, Vietnam has attracted the majority of those who wanted to diversify their manufacturing portfolio outside China, JLL pointed out.

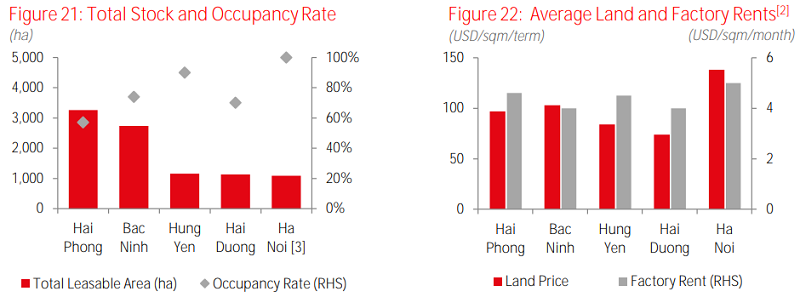

Therefore, the average land prices in the first quarter (Q1) of this year reached US$99 per square meter (sq.m) per lease term, up 6.5% on year. Ready-built factories (RBF), the favorite preference of SMEs kept the rent stable, ranging from US$3.5-5.0 per sq.m per month in Q1 and have been fully occupied.

General, demand for industrial land remained strong in Q1 thanks to Vietnam’s good industrial fundamentals. However, since February 2020 when the Covid-19 pandemic began spreading, all traffic flow has been suspended, making it difficult for investors – especially foreigners – to either implement site inspection or directly work with industrial park (IP) developers.

Multiple transactions were postponed, and most successful transactions recorded this quarter had taken place before the outbreak.

| Stocks and land prices in northern industrial market. Source: JLL Research |

The average occupancy rate, therefore, increased relatively at roughly 200 basis points (bps) compared to Q4/2019 and reached 72% in Q1/2020.

During the quarter, no new IP was launched into the market. Bac Ninh and Haiphong – with their mass supply – were still the leading industrial markets in the North. With strong industrial fundamentals, new IPs and expansion phases will continue to come on stream in these localities, JLL said.

In the long run, the postponement of ongoing leasing negotiations and new requirements will be more apparent if the situation does not improve soon, JLL said. However, the market is likely to recover and grow rapidly after the epidemic is well under control, it added.

The disruption in the global supply chain caused by the pandemic is urging businesses to diversify manufacturing portfolios, as they are too dependent on one country. Covid-19 is just catalyzing the process of shifting production, which has taken place since the trade tension last year.

Therefore, on the bright side, Southeast Asia, and Vietnam particularly, is benefiting and affirms its position as the promising destination in the future, according to JLL.